Identity Verification Solution

In today's digital era, Identity Verification Solutions have become indispensable for authenticating users and ensuring the integrity of customer databases. As a leading identity verification company, KYC UK is committed to providing comprehensive and cost-effective global identity verification services leveraging cutting-edge biometric technologies. Our identity verification software adheres to the highest standards of identification verification processes, and our identity bureau houses crucial identity data from challenging yet essential countries.

KYC UK offers businesses the best identity verification solutions, ensuring a seamless and reliable process. Our state-of-the-art identity verification software leverages cutting-edge biometric technologies and a proprietary identity verification service programming interface to validate and authenticate customer identity documents. Choose KYC UK as your identity verification provider and experience the difference in identity verification excellence.

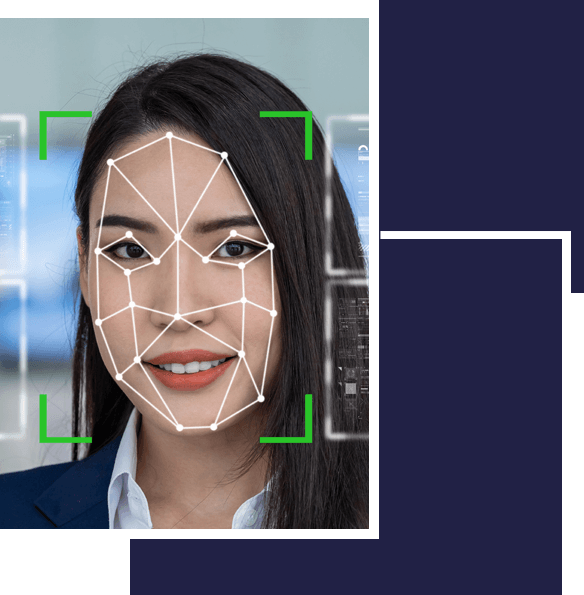

Know Your Customer (KYC) Solution

KYC is an essential process that businesses must undertake to accurately verify the identities of their clients. These regulations were introduced in 2001 with the Patriot Act, addressing crucial issues like customer identity establishment, understanding their activities, and assessing money laundering risks. To maintain a complete digital eKYC process, businesses need to develop a Customer Identification Program (CIP) and maintain Customer Due Diligence (CDD). There are three categories of due diligence: simplified, low-risk, and high-risk.

KYC UK, a leading KYC company, provides a range of KYC solutions to address critical aspects of the KYC process, including basic customer due diligence, enhanced due diligence, ongoing monitoring, superior data for KYC, and a comprehensive KYC platform. As one of the top KYC solution providers, KYC UK recognizes the significance of verifying customer identities to assess potential risks and enhance business operations. With KYC UK, businesses can maintain compliance with KYC regulations and operate with utmost confidence.

Video Know Your Customer (KYC) Solution

KYC UK stands at the forefront of video-based KYC solution providers, delivering a cutting-edge video KYC verification service that ensures secure and reliable onboarding and verification of remote customers. Through our innovative approach, customers can undergo a seamless video-based KYC onboarding experience, supported by live agents and multi-language assistance, fostering trust and security throughout the process.

Our video KYC solutions are powered by AI-informed technology, integrating biometrics and liveness detection for enhanced efficiency. By incorporating state-of-the-art technology, we minimise onboarding abandonment rates and reduce costs, ensuring a smooth and cost-effective verification process for your business. Embrace cutting-edge technology to streamline your verification process and build a strong foundation of trust with your clientele.

ID Verification Solution

KYC UK, a leading provider of state-of-the-art ID verification services, software, and solutions. Our advanced ID Verification application offers swift and accurate scanning and authentication of government-issued identity documents, such as passports, driver's licence, and national IDs. This robust tool is a crucial component of our identity fraud solutions, empowering businesses to proactively detect and prevent fraudulent activities.

Our ID Verification solution is capable of validating documents from over 175 countries, ensuring comprehensive coverage for your global customer base. Seamlessly integrated with anti-money laundering solutions, our ID Verification API delivers quick and accurate validation results in less than 6 seconds. The simple API can be smoothly incorporated into any system, streamlining your verification process. Enhance your fraud prevention measures, maintain compliance, and safeguard your operations with our top-notch ID verification services. Explore the possibilities of secure identity verification with KYC UK today.

Age Verification Solution

Age Verification plays a pivotal role in safeguarding businesses from underage customers and fraudulent activities. Efficient KYC checks not only reduce the risk of financial penalties but also uphold the integrity of your brand. Age verification processes are essential for industries such as alcohol distributors, tobacco companies, vaping industries, adult-only sectors, financial institutions, online gaming firms, lottery companies, restricted access websites, and age-restricted commerce vendors.

Our age verification solutions harness official data sources from across the globe to validate consumers' ages, enabling businesses to minimise financial, legal, and reputational risks. Our age verification software offers a swift and straightforward process to verify personal identities. The KYC UK Age Verification platform utilises billions of records to compare visitor data, providing benefits like fraud and risk management, customer age verification, KYC compliance, faster account approval, identity theft prevention, and upholding your esteemed reputation.

Anti-Money Laundering Solutions

KYC UK presents a comprehensive suite of AML solutions tailored to assist businesses in mitigating risks and combating fraud. Our AML compliance and identity verification services ensure a smooth and secure customer onboarding process, setting the foundation for trust and security. Our AML platform incorporates cutting-edge technology for enhanced due diligence, allowing swift detection and prevention of suspicious activities. With real-time risk mitigation through API access to a vast global database of over 15 million bad actors and politically exposed persons (PEPs), you can rest assured of a secure business environment.

KYC UK's AML software empowers you to screen customers against watchlists and sanctions lists from more than 1200 jurisdictions worldwide. Equipped with advanced monitoring technology, our platform efficiently detects high-risk profiles and proactively monitors potential risks associated with customer profiles, ensuring ongoing compliance and risk management. Partner with us today and experience the confidence of having a trusted ally in your AML compliance journey.

Know Your Business (KYB) Verification Solution

Welcome to Know Your Business, where we provide automated KYC services that allow businesses to better understand their customers and effortlessly verify essential corporate data. Our KYC ID verification process is designed to prevent fraudulent activities and achieve the highest match rates, all while ensuring compliance with KYB regulations.

Integrate our KYC API into your existing compliance programs and accelerate the onboarding of new business customers. Partnering with us enables you to establish lasting business relationships and gain access to exclusive Beneficial Owners (UBOs) and business addresses while adhering to the strictest encryption and security standards mandated by law. Our service ensures a seamless business onboarding experience with minimal human involvement.

- Forge enduring business relationships with KYB

- Nurture enduring business connections with KYB

- Build lasting and sustainable business alliances with KYB

Know Your Business (KYB) is a premier provider of business verification services, offering a unique business identity verification solution. As a leading KYB provider, KYB offers businesses the ability to identify and verify critical corporate data, prevent fraud, and achieve best-in-industry match rates. KYB also helps businesses remain compliant with KYB regulations, scale existing compliance programs, onboard new business customers quickly, build long-term business relationships, gain access to unique Beneficial Owners (UBOs) and business addresses, and meet the highest encryption and security standards required by law. KYB is a comprehensive KYB solution that provides a frictionless business onboarding experience and requires zero human interaction, ensuring that businesses can effectively and efficiently verify their customers' identities.

Client Onboarding | Seamless Customer Onboarding

At KYC UK, our customer onboarding solutions are thoughtfully designed to guide customers through various stages of their journey. By ensuring a smooth onboarding experience, we prevent customer abandonment and foster higher customer retention rates. Our platform streamlines the onboarding process, leaving a positive impression that builds brand trust and drives company revenue. KYC UK, your go-to destination for comprehensive customer onboarding solutions. Our cutting-edge software and robust customer onboarding platform empower organisations to successfully engage and convert customers. We understand that a seamless onboarding program is vital for building long-term relationships with clients, and our solutions are designed to deliver just that. At KYC UK, we're committed to making your customer onboarding process efficient and effective, setting the stage for long-lasting customer relationships.

PEP & OFAC Verification

At KYC UK, our identity verification solution provides essential PEP verification and OFAC verification services to ensure businesses meet regulatory requirements concerning politically exposed persons (PEPs). Politically Exposed Persons are individuals holding significant public positions either domestically or internationally, as defined by the Financial Action Task Force (FATF).

Ascertaining the level of risk associated with PEPs involves evaluating factors such as their influence, monetary involvement, and the prevalence of corruption and money laundering in their respective countries. With our seamless integration and reliable OFAC verification solutions, you can confidently conduct PEP checks and maintain compliance and vigilance in all your transactions. Stay secure and compliant with KYC UK's advanced verification services.

Customer Due Diligence | Behavior Monitoring Solution

At KYC UK, we offer comprehensive and efficient customer onboarding solutions, powered by cutting-edge software and a robust platform. A successful onboarding program is vital for organisations to engage and convert customers, and our solutions are designed to deliver a seamless customer experience that fosters long-term relationships. Our platform guides customers through various stages of the customer journey thoughtfully, reducing customer abandonment, and increasing retention. With our customer onboarding solutions, we simplify the process and create a smooth onboarding experience, crucial for building brand trust and boosting company revenue. By leveraging our customer onboarding software, businesses can reduce customer abandonment and reinvest those resources into creating exceptional customer experiences..